GOLD DOWN DESPITE FEARS OF SECOND WAVE OF CORONAVIRUS | FOREX RECOMMENDATIONS

The yellow metal starts the week on a negative note even though the number of coronavirus cases has started to increase in China and the U.S, reigniting fears of the second wave of the virus.

China, where the first outbreak began reported 57 cases on June 13. While the U.S states like California, Texas, Florida, North Carolina, Arizona, and Alabama reported more than 1000 cases each on Sunday.

As of now, gold is trading at 1727.25, down by 0.34%.

Talking about the previous session, initially, the bullion touched an intraday high of 1743.13 on the back of falling global equities as investors feared the number of rising COVID -19 cases in some parts of the U.S. However, in the American session, the equity markets were able to make up for some of the losses after the U.S Prelim UoM Consumer Sentiment data came better than expected. As a result, the bullion lost some of its safe-haven bids and concluded the day at 1729.65 with a 0.13% gain.

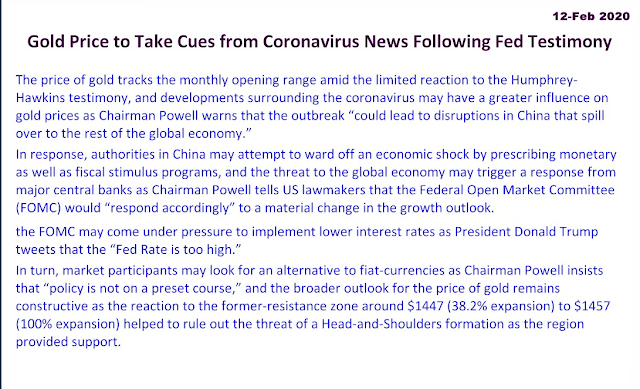

On the data front, the investors will keep close attention to the U.S Fed testimony before the Congress on Tuesday. The markets are widely expecting Powell to maintain his gloomy stance on the U.S economy.

Traders/Investors can ping me for Live trades on Telegram : Financial Advisor

#forex #FX #trading #forexsignals #forextrading #ForexNews #FXTrading #FXTrader #ForexTips #signalservice #makemoney #USDJPY #EURUSD #GBPUSD #USDCHF #AUDUSD #NZDUSD #Profit

Comments

Post a Comment