US Recession Overviews, April 2020 - US ECONOMIC DATA TURNING DOWN

US Recession Watch, April 2020 - Recession Odds Artificially Low

US RECESSION WATCH OVERVIEW:

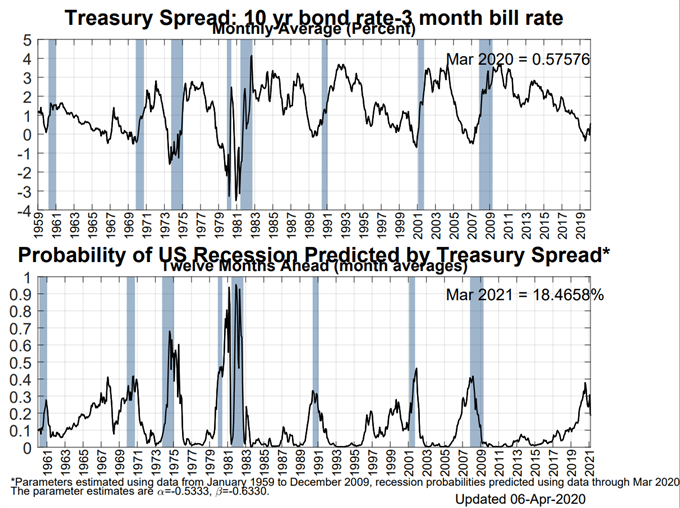

- Recession odds are rising once again, no surprise due to recent jobless claims data around the coronavirus pandemic. The 3m10s spread is currently 54.5-bps; onthe last day of November it was 22.1-bps.

- But recession odds may be artificially low: there is an 18% chance of a chance of a recession hitting the United States within the next 12-months, according to the NY Fed Recession Probability Indicator.

- As US recession odds fade, traders have pushed back the timing of the next Fed rate cut to July 2020.

DM For more Live Signals with fluctuate market situation and Impact: https://bit.ly/2QI6gO8

US RECESSION FEARS RISING RAPIDLY, IN A SENSE

It’s been several months since our last update on US recession odds, in part due to the fact that this strategist was on paternity leave for the birth of his first child. But now that I’m back at the desk fulltime, a high-level look at the state of the US economy is necessary.

To this end, the global and US economies are in a very different place than they were at the end of January; equity markets continued to chug higher, thanks in part to the relief that the US-China trade deal brought to investors. One global pandemic and nearly three months later, it now appears that the global economy is in the worst position since the Great Depression, and it could be worse.

US RECESSION FEARS RISING RAPIDLY, IN A SENSE

It’s been several months since our last update on US recession odds, in part due to the fact that this strategist was on paternity leave for the birth of his first child. But now that I’m back at the desk fulltime, a high-level look at the state of the US economy is necessary.

To this end, the global and US economies are in a very different place than they were at the end of January; equity markets continued to chug higher, thanks in part to the relief that the US-China trade deal brought to investors. One global pandemic and nearly three months later, it now appears that the global economy is in the worst position since the Great Depression, and it could be worse.

US ECONOMIC DATA TURNING DOWN, TRACKERS ARE STALE

US economic data being released over the past few weeks still does not begin to capture the effects of the economic slowdown that took root in the second half of March. As a result, the Federal Reserve’s individual branches’ GDP forecast models are lagging in producing accurate results regarding the coronavirus pandemic’s impact on the US economy.

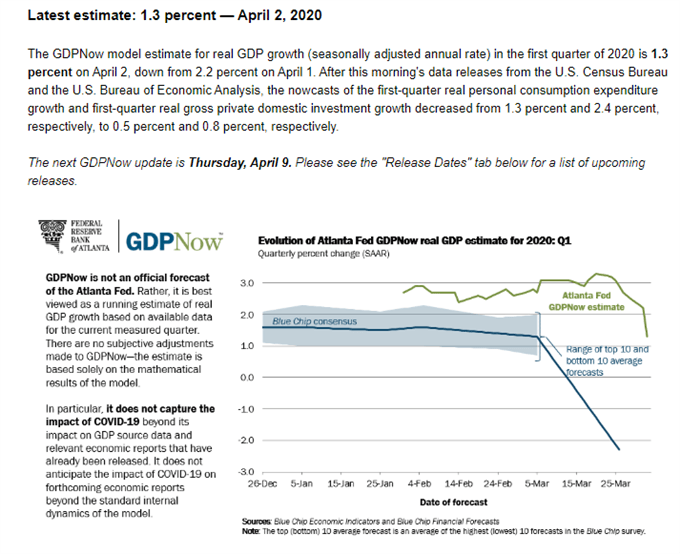

ATLANTA FED GDPNOW Q1’20 US GDP ESTIMATE (APRIL 8, 2020) (CHART 1)

As it stands, Q1’20 US GDP expectations have slid rapidly, from their high at 3.2% in mid-March to 1.3% where they stand today. But the Blue Chip consensus forecast is calling for a much steeper decline in growth, already at -2.3%. Still, the data seem stale. Banks and economic forecasting institutes otherwise have been predicting that, while Q1’20 may seem bad, Q2’20 will be much worse: annualized GDP is estimated to contract in the neighborhood of -20% to -30%.

As it stands, Q1’20 US GDP expectations have slid rapidly, from their high at 3.2% in mid-March to 1.3% where they stand today. But the Blue Chip consensus forecast is calling for a much steeper decline in growth, already at -2.3%. Still, the data seem stale. Banks and economic forecasting institutes otherwise have been predicting that, while Q1’20 may seem bad, Q2’20 will be much worse: annualized GDP is estimated to contract in the neighborhood of -20% to -30%.FED RATE CUT CYCLE BOTTOMS OUT; QE OR BUST

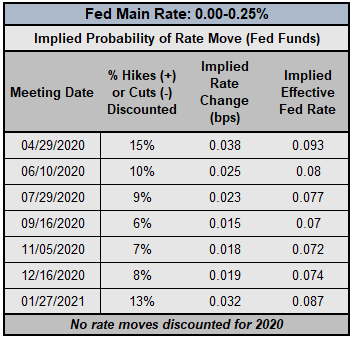

With the Federal Reserve already having enacted emergency interest rate cut measures, rate markets are more or less stuck in a state of suspended animation. If the Fed is going to do anything from here on out, it’s going to come via more QE, a repo facility, etc.

FEDERAL RESERVE INTEREST RATE EXPECTATIONS (APRIL 8, 2020) (TABLE 1)

USING THE US YIELD CURVE TO PREDICT RECESSIONS

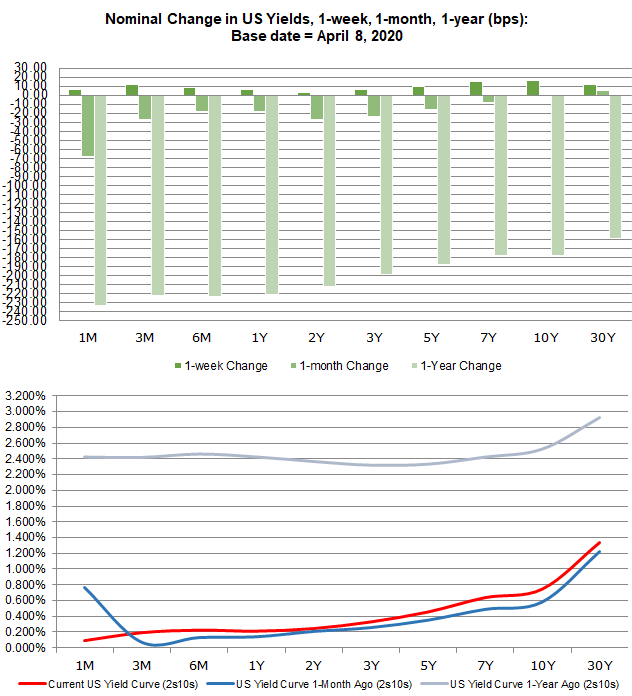

The US Treasury yield curve has started to normalize. The relatively faster rise by long-end yields compared to short-end yields may be seen as a sign that market participants believe that the worst period of uncertainty around the coronavirus pandemic and its influence on the US economy is behind us; the yield curve is no longer inverted at the short-end of the curve (the 1-month bill yield was greater than all but for the 30-year bond yield).

US TREASURY YIELD CURVE: 1-MONTH TO 30-YEARS (APRIL 8, 2020) (CHART 2)

Still, it appears that the US will fall into recession soon; long-end yields are viewed as a proxy for growth and inflation expectations, and they remain significantly depressed from where they stood a few months ago, nevermind a year ago.

A REFRESHER: WHY DOES THE US YIELD CURVE MATTER?

Market participants use yield curves to gauge the relationship between risk and time for debt at various maturities. Yield curves can be constructed using any debt, be it AA-rated corporate bonds, German Bunds, or US Treasuries.

A “normal” yield curve is one in which shorter-term debt instruments have a lower yield than longer-term debt instruments. Why though? Put simply, it’s more difficult to predict events the further out into the future you go; investors need to be compenstated for this additional risk with higher yields. This relationship produces a positive sloping yield curve.

When looking at a government bond yield curve (like Bunds or Treasuries), various assessments about the state of the economy can be made at any point in time. Are short-end rates rising rapidly? This could mean that the Fed is signaling a rate hike is coming soon. Or, that there are funding concerns for the federal government. Have long-end rates dropped sharply? This could mean that growth expectations are falling. Or, it could mean that sovereign credit risk is receding. Context obviously matters.

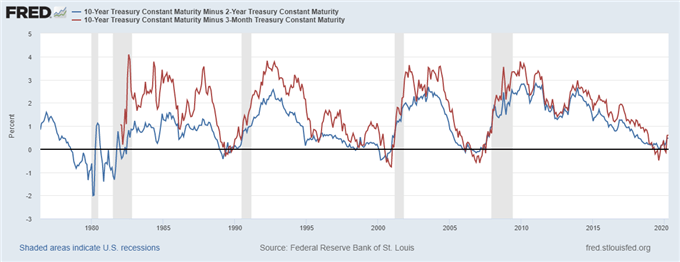

US TREASURY YIELD CURVES: 3M10S AND 2S10S (1975 TO 2020) (CHART 3)

There is an academic basis for yield curve analysis. In 1986, Duke University finance professor Campbell Harvey wrote his dissertation exploring the concept of using the yield curve to forecast recessions. Professor Campbell’s research noted that the US yield curve needs to invert in the 3m10s for at least one full quarter (or three months) in order to give a true predictive signal (since the 1960s, a full quarter of inversion has predicted every recession correctly).

NY FED RECESSION PROBABILITY INDICATOR (APRIL 8, 2020) (CHART 4)

US recession odds remain artificially low, according to the relationship provided by the Treasury spreads. Efforts by the Federal Reserve to buoy risk appetite have alleviated short-term fears, in a sense that the 1-month bill yield is now the lowest on the curve (as it should be in normal circumstances). To this end, there is currently an 18% chance of a US recession in the next 12-months, per the NY Fed Recession Probability Indicator; a conclusion we know to be sorely wrong.

CONCLUSIONS ABOUT US YIELD CURVE NORMALIZATION AND US RECESSION ODDS

The coronavirus pandemic and the destruction its wrought, both in economic and human life terms, has materially altered the state of affairs over the past three months (no kidding). It’s important to place some of the recent economic data in context. The scope and scale of US jobs losses over the past two weeks (per initial claims data) rivals that during 1929 to 1933 during the Great Depression (adjusting for the sizes of the US population and labor force).

Or Whatsapp: https://wa.me/971547799108

#UK #UAE #فوركس #Germany #Spain #Greece #ukfx #Malaysia #Singapore #Australia #فوركس #سعودي #عرب #ذهب #金 #金信号 #外汇交易 #黄金交易 #外汇交易 #Brexit #finances #igmarket #USD #FBS #fxtm #Goldmarket

#GBPUSD 𝗙𝗢𝗥𝗘𝗫 𝗚𝗢𝗟𝗗

Comments

Post a Comment