News Impact on Market

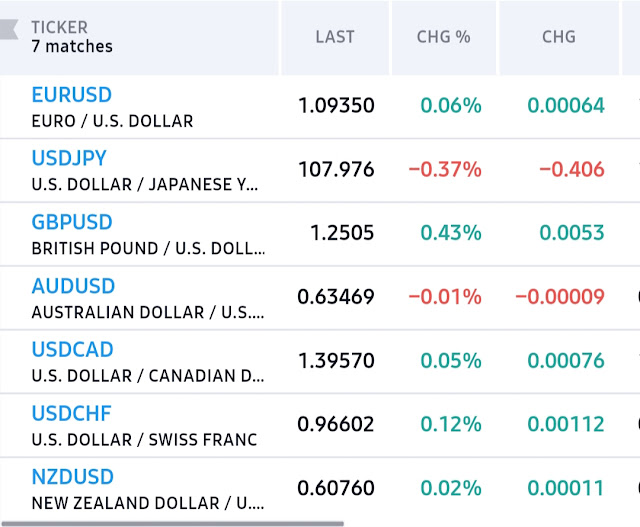

Market Overview: #Commodities: The day after the #OPEC & allies led by Russia agreed to reduce output by 9.7 million barrels per day (bpd) in May & June #Dow30 will be down again with a new target of 20000 Index points. A Good Sell from high. #DAX30 will also be impacted with this news and it will be down to 9000 points again. To know the best entry & exit levels. PING ME :https://bit.ly/2QI6gO8 Do you want to know insides, best entry prices to short or buy now Contact me on Telegram : https://t.me/forexpersonalguider Or Whatsapp: https://wa.me/971547799108 #UK #UAE #فوركس #Germany #Spain #Greece #ukfx #Malaysia #Singapore #Australia #فوركس #سعودي #عرب #ذهب #金 #金信号 #外汇交易 #黄金交易 #外汇交易 #Brexit #finances #igmarket #USD #FBS #fxtm #Goldmarket #Stayhome #coronalockdown #lockdownextended #GBPUSD 𝗙𝗢𝗥𝗘𝗫 𝗚𝗢𝗟𝗗 Forex signals live forex signals online forex signals forex trading signals forex accurate signals